47+ how much does mortgage interest deduction save

If youre single you should. Web Essentially you may be able to deduct the interest of up to 100000 of the debt as well as 130th of the points each year assuming its a 30-year mortgage.

Do Traditional 401 K Fsa And Hsa Contributions Reduce Your Tax Liability Even If You Don T Itemize United States Taxes Income Tax 401k Tax Deduction Money Quora

Compare More Than Just Rates.

:max_bytes(150000):strip_icc()/GettyImages-1282179800-9e2c7156becb49d892d01207b646e7ce.jpg)

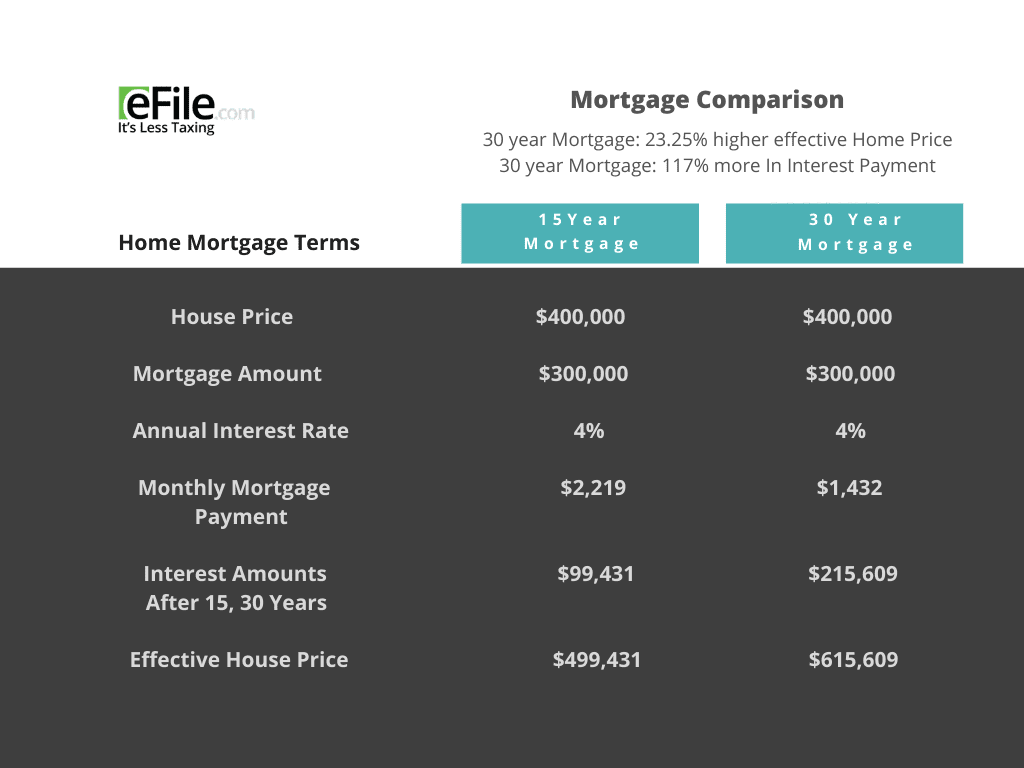

. If you took out your home loan before. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web The maximum amount you can deduct is 750000 for individuals or 375000 for married couples filing separately.

Web However in general you can deduct any mortgage interest that you pay on up to 750000 of debt any points you had to pay to get your mortgage or to pre-pay. 2 minutes The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply. Get Your Max Refund Guaranteed.

Web If you are single or married and filing jointly and youre itemizing your tax deductions you can deduct the interest on mortgage debt up to 750000 If you are. Annual income - 500000 W2 employee max out Roth and 401k. Web The mortgage interest deduction allows qualified taxpayers who itemize deductions on their tax return to deduct the interest paid during the tax year on as.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Homeowners who bought houses before. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

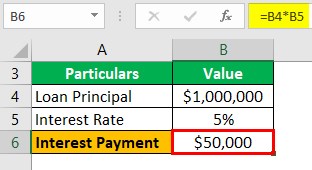

Get Your Taxes Done w Expert Help In-Office or Virtually or Do Your Own w On-Demand Help. Web Mortgage 800000 down payment of 100000 Interest rate 5 30 year fixed. Use this calculator to determine your.

Get Live Help From Tax Experts Plus A Final Review Before You File - All Free. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage. Web In other words the Mortgage Interest Deduction would save this American 1163 per year in federal income tax.

Web March 4 2022 439 pm ET. Ad Dont Leave Money On The Table with HR Block. Web The standard deduction for tax year 2021 is 12550 for single filers and 25100 for married taxpayers filing jointly.

Web With the interest on a mortgage being deductible when you itemize deductions it may surprise you how much you can save in taxes. Web The mortgage interest deduction means that mortgage interest paid on the first 1 million of mortgage debt can be deducted from your taxes through 2025. Over the course of 30 years that annual number.

Web Taxpayers can deduct the interest paid on qualified residences for up to 750000 in total mortgage debt the limit is 375000 if married and filing separately. For tax year 2022 those amounts are rising to. Find A Lender That Offers Great Service.

Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. See If You Qualify To File 100 Free w Expert Help. Ad For Simple Returns Only.

Web Supposing that your top marginal tax rate is 32 percent the deduction will save you 5120 on your taxes 32 percent of 16000.

Mortgage Interest Deduction A 2022 Guide Credible

Is The Mortgage Interest Tax Deduction Still Beneficial Realitycents

How Much Mortgage Interest Can You Deduct On Your Taxes Cbs News

Mortgage Interest Deduction Bankrate

Mortgage Interest Deduction Bankrate

What Tax Breaks Do Homeowners Get In New York

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

:max_bytes(150000):strip_icc()/property-tax-deduction-3192847_final-ca30dd2f9dcc4ce5b97d8a9e5615b3c7.png)

Tax Deductions For Interest On A Mortgage Refinancing

2023 Tax Deduction Cheat Sheet And Loopholes

5 Parts Of Your Mortgage Payment Axis Bank

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Four Types Of Loans That Help You Avail Tax Benefits Axis Bank

Maximum Mortgage Tax Deduction Benefit Depends On Income

Mortgage Interest Deduction How It Calculate Tax Savings

Home Mortgage Loan Interest Payments Points Deduction

Mortgage Interest Deduction Rules Limits For 2023